What is a mill levy and why does it need an override?

By John Gardner

The Surveyor

The Thompson School District Board of Education has approved two initiatives for the November ballot; both seek to raise the mill levy rates for property tax payers within the school district collectively by 17 mills.

But how much will this cost the average homeowner? That’s a tricky calculation. Let’s start by breaking down the tax rates in the district.

To start, mills are a factor applied to assessed property value that determines a property’s total tax bill. The assessed value isn’t “actual” or “market” value of the property.

In the State of Colorado, the Gallagher Amendment to the Colorado Constitution, passed in 1992, stipulates that a relationship be maintained, on a statewide basis, between the amount of a property tax paid on residential property (45 percent) and the amount paid on nonresidential property (55 percent). The state legislature sets the residential assessment rate once every two years to maintain that relationship. The residential rate for 2015 and 2016 is 7.96 percent. The assessment rate on nonresidential property, including commercial, industrial and everything not considered residential, is fixed at 29 percent, according to the Larimer County Assessor Steve Miller.

“Commercial properties by far pay the most amount of taxes,” Miller said.

Miller said the Gallagher Amendment was designed to keep residential property taxes low and has managed to be more successful than was even expected at the time it was implemented.

All properties are reappraised on a two-year cycle in odd-numbered years. The actual value assigned to residential properties in 2015 and 2016 is based on market values as of June 30, 2014, as defined by sales of residential property in the 60-month period from July 1, 2009, to June 30, 2014.

Assessor’s offices across the state use exterior measurements of homes and buildings to determine an approximation of the structure’s square footage. This assessment may differ from an appraiser or realtor’s as they typically take interior measurements. However, the valuation procedures used by the assessor are adjusted to account for the use of exterior measurements, which helps to assure as accurate values as possible.

The assessor’s office uses all this information to determine the property’s taxable value. Property taxes are calculated using the following calculation: Actual value multiplied by the assessment rate results in a property’s assessed value. The assessed value is multiplied by the mill levy rate then divided by 1,000 to determine the property’s tax bill.

For example: A house in downtown Berthoud with an actual value of $173,000 has an assessed value of $13,787. The mill rate for that particular area in Berthoud is 88.954. So, this property pays an effective tax bill of around $1,226 per year.

For comparison, the similar home in downtown Loveland has an assessed value of $13,787 as well, but has a lower mill levy rate of 72.741, because it is in a different tax district. So, the property tax bill for the Loveland residence is around $994. The reason for the difference in tax amounts is because within Larimer County there are 702 taxing districts. Each district has a different mill levy depending on how many authorities, such as a fire, recreation, or library district, are levying taxes.

“These properties may not be that far from one another physically, but the tax implications are significantly different,” Miller said.

That’s why property owners in Loveland and Berthoud, while both in the Thompson School District, pay different amounts of property tax.

For example: Tax district 1614 in Timnath, north of Fort Collins, has a mill levy rate of 135.15 and includes a mill levy rate of 52 mills for the Poudre R-1 School District. One rural tax district, No. 20152, has a mill levy of 185.6 mills while other areas have mill rates as low as 69 mills.

The Berthoud house described above is in tax district 2400 and has a mill rate of 88.95 mills, which includes a mill levy rate of 38 mills for the Thompson School District.

But when an entity such as the school district requests a mill levy override to increase funding for the school district, that increase in mills is uniform across the school district, which in this case encompasses both Loveland and Berthoud residences. In this particular case, the Thompson School District’s two new ballot issues, if passed by voters in November, would increase the school district’s mill rate by 17 mills, from 38 to 55.

The Thompson School district mill levy request estimates an increase of 7.1265 mills, based on 2016 assessed valuation; which would increase property taxes by $56.73 per $100,000 of actual home value per year. So, those $173,000 homes in Berthoud and Loveland would have an increase of approximately $96.44 per year on their tax bill, or roughly $8 a month.

Additionally, the school district also proposes a $288.5 million bond issue that is estimated to increase the mill rate by 9.845 mills. The district estimates that impact to be $78.37 per $100,000 actual home value per year; an additional $133.23 per year for the Berthoud home with an actual value of $173,000 within that particular district, or roughly $11.10 per month.

If both the Thompson Reinvented Bond issue and the mill levy override were to pass in November, the property taxes on the $173,000 home in that particular district would increase by approximately $230 annually, or $20 a month.

Residents can find their own property tax information by visiting the Larimer County Assessor’s Office website at Larimer.org/assessor. There, property owners can find their specific tax information under the “Inquire by data selection” tab. That page will provide property owners with their specific tax district. To view information about where your taxes go, click on the “Forms and reports” link under the Assessment Information section on the assessor’s home page.

- February, 10 2022

Care and companionship for caregivers...

Give me a break! The silent or maybe not-so-silent plea of anyone caring for a...

- September, 19 2018

County mourning loss of Commissioner ...

Special to the Surveyor The Larimer County Board of Commissioners is saddened to announce that...

- June, 21 2019

Veteran’s Corner

By Ryan Armagost The Surveyor June has many dates and events that bring remembrance to...

- October, 27 2016

Yellow Iron Invasion

Construction is progressing on a regional collector line that will drain...

- April, 20 2018

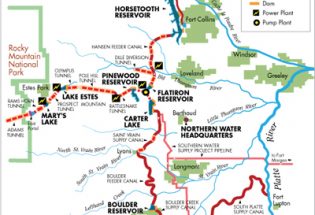

Good news about your water supply

Special to the Surveyor Strong regional water storage coupled with below-average precipitation prompted the Northern...

- April, 01 2022

OPINION: No one should ever have to d...

“No one dies alone” or SB22-053 is probably the most important bill I have ever...

Snowpack at 119% above normal

Community News

Karspeck to serve third term as Berthoud mayor

Community News

OPINION – No bitchin’ allowed

Community News

Roy Tripi to become principal of BHS on July 1

Community News

Berthoud Sports Hall of Fame announces 2024 inductees

Community News

Girls helping girls: a compassionate Girl Scout project

Community News

Longview Campus served 1,000-plus since opening

Community News

COMMUNITY CALENDAR:

Community Calendar – add an event

Homestead Fine Art Gallery First Fridays OPEN HOUSE

03 May 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

07 Jun 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

05 Jul 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

02 Aug 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

06 Sep 4:00 PM - 7:00 PM

Homestead Fine Art Gallery First Fridays OPEN HOUSE

04 Oct 4:00 PM - 7:00 PM